GROCERY WARS – “DOLLAR STORES – THE EMERGING FOOD RETAILER FOR CONSUMERS”!

The popularity and growth of Dollar Stores in this country is a story for the ages. First introduced into the Canadian market more than 30 years ago, selling discount greeting cards and gift wrap, today they have become Canada’s fastest growing grocery channel. So, who are Canada’s leading Dollar Store chains, why have consumers turned to Dollar Stores, who is their typical shopper, and what growth have they achieved in the food sector?

Canadian Dollar Store Chains

Canada’s leading Dollar Store chain is Dollarama. September 2014, they operated over 900 stores. Their expansion plans include 70-80 new stores per year with a goal to operate over 1,200 retail outlets. Their main competitor is Dollar Tree, a US based firm with over 13,000 retail outlets. Presently operating 200 stores in Canada, their expansion plans are to operate 1,000 stores. Dollarama currently controls 60% of the Dollar Store market share.

Decline in Consumer Spending Leads Consumers to Dollar Stores

Canadian families are increasingly becoming cash strapped as they have seen their personal finance situations deteriorate the last couple of years. A new study suggests nearly one-quarter of Canadians are worried about how to pay for groceries, with more than 50 percent shifting their shopping habits amid fluctuating food prices.

Nielsen’s study entitled “What Makes the Consumer Tick”, identified consumers top 3 concerns as:

- Economy: Canada has become a part-time job creation nation with stagnant wages.

- Food prices: Food prices have increased steadily over the last couple of years.

- Utilities: Electricity prices, specifically in Ontario are among the highest across North America.

As part of the same study, Nielsen segmented the consumer into 3 different shopper categories. Their research revealed “Canadian Spending Power in Decline”. Table 1 breaks down the shopper segments and the decline in their shopping power over the past 5 years.

Table 1

Canadian Shopper Segments

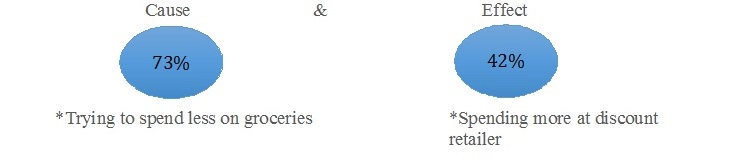

The consumers quest to save is defining retail trends.

Seeking ways to reduce their food bills, consumers have turned to Dollar Stores. Today Dollar Stores household penetration level is 76.3%. Their household penetration level in 2011 was 72.3%.

Dollar Stores Shopper Profile

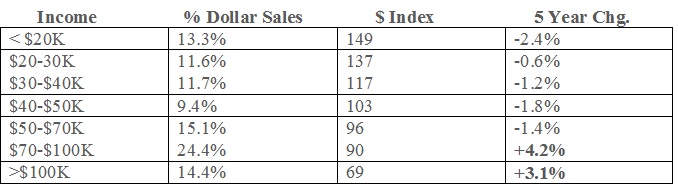

Though Dollar Stores continue to skew to lower income households, they are starting to gain greater prominence with higher income households. In the US, +40% of Dollar Store business comes from households with incomes of more than $70,000. Table 2 breaks down the Canadian Dollar Stores shopper profile.

Table 2

Dollar Stores Shopper Profile

Dollar Stores Growth in Food

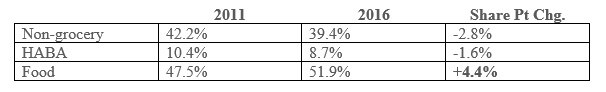

Dollar Stores CPG sales growth is 10%, tops in the grocery sector. Today food now accounts for over half of Dollar Store CPG sales. Table 3 outlines Dollar Stores product mix.

Table 3

Dollar Store Product Mix

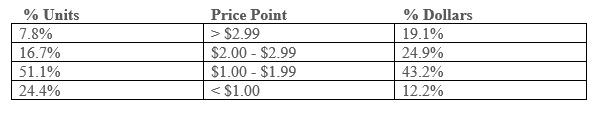

Though Dollar Stores sell products at various price point, those units priced between $1.00 – $1.99 still account for over half of all units sold. Table 4 breaks down their sales by price point.

Table 4

Unit Sales by Price Point (Average price per unit)

With consumers purchasing more food from Dollar Stores, their forecasted market share of the CPG sector is anticipated to reach 1.9% by 2020. Chart 1 outlines Dollar Stores CPG market share growth since 2011.

Chart 1

Dollar Stores CPG Market Share

Dollar Stores – The Opportunity for Food Brands

Dollar Stores as a potential distribution channel for food brands can no longer be dismissed. They have arrived and overtaken the destination place for many CPG consumers. Those brands who embrace this channel will come out ahead in the long run as today’s economy continues to sputter along. Do not dismiss them just to shelf stable foods. Though not available now, milk and cheese may become the next food categories to enter this channel as they have in US. Skeptical! Who ever thought Drug Stores would sell milk, cheese and frozen foods?

For more help Getting and Staying Listed in Canada’s Grocery Sector, connect with us through our website: www.fooddistributionguy.com or give us a call toll free: 1-844-206-FOOD (3662).