COVID-19 and the Online Food Channel

Growing up is was common practice for the milkman to deliver our milk directly to our home. When my dad designed our new home, he created a milk slot which was open to the outside, but locked in the inside. When finished we would put our empties back and the milkman picked them up. Though extremely primitive, this is the first experience of e-commerce as I know it. The new age of the online food sector came about in 1996 when Grocery Gateway was conceived, that was subsequently purchased by Longo’s in 2004. Up to now, Canadians have been risked adverse to ordering their groceries online. The online grocery market share for the 52-week period ending March 28, 2020 was 1.2%[i]. This is in contrast to the US in which e-commerce accounted for roughly 7% of U.S. food and beverage retail sales in 2019, and close to 10% in Europe.[ii]

Due to COVID-19, e-commerce has become the fastest-growing channel globally for fast-moving consumer goods (FCMG) and Canadians have woken up and embraced this sector.

It should come as no surprise the online market has become supercharged in Canada. Dalhousie University in March of this year revealed only 24% of Canadians felt comfortable with the idea of grocery shopping. In other words, more than three-quarters of Canadians viewed the grocery store as an inherent risk.[i] During this pandemic:

- Online shopping has increased by 58%.[ii]

- 39% of online grocery shoppers were first-time grocery buyers. 81% of these consumers indicated they were likely to continue shopping online.[iii]

The top 4 reasons why consumers indicated they would continue online shopping:

- Convenience.

- Organized list.

- Easier to find deals.

- Health and safety concerns.[iv]

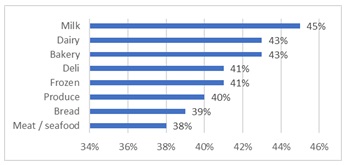

The Hartman Group (US research firm) immerses itself in the study of American food and beverage culture. As part of their study titled: “US Grocery Shopper Trends: The Impact of COVID-19, they identified the products purchased most regularly for the first time online among shoppers as outlined in Chart 1.

Chart 1

Products Bought for First Time Online Among Online Shoppers[v]

Though e-commerce grocery sales are cooling as restrictions across the country are lifted, “but there’s an opportunity for long-term growth”, Empire CEO Michael Medline, predicting e-commerce could reach 5% share of the Canadian grocery market over the next five years.[vi] Diane

Brisebois, CEO, Retail Council of Canada is a little more optimistic about the Canadian e-commerce food market. “I expect that we’ll see us catch up to the U.S. and to Europe,” she said. “There is a lot of thought going into what e-commerce means for the traditional grocery store.”[vii]

Though brick & mortar will continue to be the dominant FMCG channel after COVID-19, brands can no longer dismiss the online Canadian market. For smaller brands’ come prepared to drive brand awareness and stimulate trial purchase both in-store and online, as the majority of Canadians undertaking the grab and go philosophy, 73% in brick & mortar and 59% online.[viii]

References:

[i] Why COVID-19 Will Change Canadian Grocery Industry Forever: Expert, www.retailinsider.com, March 2020

[ii] 57% Spike in Online Grocery Shoppers, Report, www.grocerybusiness.ca, April 2020

[iii] COVID-19 and Shifting Shopping Behaviours, Canadian Grocer Webinar, June 2020

[iv] COVID-19 and Shifting Shopping Behaviours, Canadian Grocer Webinar, June 2020

[v] US Grocery Shopper Trends: The Impact of COVID-19, The Hartman Group, May 2020

[vi] Michael Medline on the Future of E-Grocery, www.canadiangrocer.com, June 2020

[vii] New Normal, How COVID-19 Could Change Canada’s Grocery Landscape Forever, www.ctvnews.ca, April 2020

[viii] COVID-19 and Shifting Shopping Behaviours, Canadian Grocer Webinar, June 2020