The Emergence of the Dollar Store in Today’s Economy

In the early 1990’s I remember the first Dollar store opening up in the GTA. Having identified this new retail channel, I brought it to the attention of Senior Management in Canada, and the United States. My concerns were unheeded by Senior Management, and I was told they would never become a serious threat to their business model. Given Dollar stores have become the destination for a growing number of Canadians, I would like to revisit that discussion today to gauge if they lament their decision. As many grocery banners struggle with declining volumes, this past December, Dollarama announced, that sales grew 11.1% as the number of transactions rose by 10.4%, and the average transaction size gained 0.6%.[1] With Canadians under inflationary pressure, am I surprised, No. You know times are tough when you see BMWs parked in front of Dollar stores.

Canada’s Leading Dollar Store Chains?

Dollarama is Canada’s leading Dollar store chain. Having opened up their first store in 1992, today they have become a household name and shopping destination for Canadians coast to coast. As of April 2023, Dollarama operated 1,548 locations, with plans to operate 2,000 locations by 2031. Since 2009 they have become Canada’s largest retailer of items for $5 dollars or less. Dollar Tree – US based chain ranked 137 on Fortune 500 list, operates 227 locations in 5 Provinces and Territories across 146 cities. A Buck or Two operates 50 stores.

Who is the Dollar Store Customer Base?

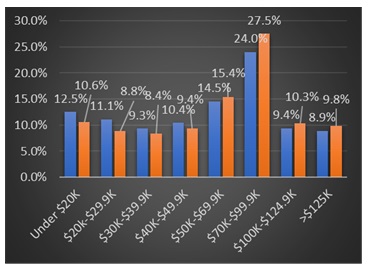

More than 1 in 5 consumers buy groceries at dollar stores.[2] In 2023, 47.3% of Canada’s Dollar store customer base came from household incomes of +$70K, as compared to 42.3% in 2022. This represents an increase of 11.8%.[3] Please refer to Appendix 1.

Why Do Consumers Purchase from Dollarama?

Half of Dollarama customers believe they offer the lowest prices in the market:

- 40% of Dollarama shoppers believe they save at least 10% when buying products of comparable quality.

- 56% of Dollarama shoppers believe the banners offer the lowest everyday prices in Canada.[4]

What is Dollarama’s FMCG Offering?

Dollarama does not offer customers a vast selection of products like larger grocery chains. Their business model is very lean. They keep things tight with operational costs, which ties into how Dollarama keeps their prices on name-brand items lower.

As a comparison, a D’Italiano loaf of bread retails in Dollarama for $2.50 as compared to $4.59 in Metro.

Their product mix is 68% private label and 32% branded. Consumable products account for 42% of Dollarama’s offering.[5] The average Dollarama offers a 200’ aisle of shelf stable food items, including but not-limited to cereal, bread, snacks, spices, and condiments. Most of the items listed are branded formats.

Dollarama Food Isle

What is the Sales Volume for FMCG in Dollar Stores?

In 2019, food sales through Dollar stores were estimated at over $2B dollars.[6] In 2023, only Dollar stores and discount retailers in Canada experienced unit sales increases as compared to 2022.[7] Over the 52-weeks, p/e December 30, 2023, Dollar stores experienced a 14.1% increase in dollar sales, and a +6.1% increase in unit sales.[8]

I leave you with this quotation which summarizes the value of Dollar stores:

“No Matter How Bad It Gets, I’m Always Rich at the Dollar Store”

Food Distribution Guy’s 3 Brand Strategies – Brand Perspective!

- Dollar Stores have become the destination for all Canadians regardless of income. Brands would be wise to create a retail strategy for this channel.

- Price is the dominant motivator for the Dollar store consumer. Brands must ensure they are competitively priced.

- Product innovation is critical during this period. With limited FMCG private label in Dollarama’s, brands would be wise to present unique food offerings.

Appendix 1

Dollar Stores Customer Base (Income Level) in Canada, 2022 vs. 2023

[1] Dollarama Reports Q3 Profits, and Sales Up, Raises Comparable-Store Sales Guidance, www.ctvnews.ca, December 13, 2023

[2] Amid Food Inflation, More Shoppers Turn to Dollar Stores for Groceries, www.cnbc.com, February 2023

[3] A Last NIQ+FHCP Look at a Very Special Year, Nielsen Consumer LLC, 2023

[4] A Last NIQ+FHCP Look at a Very Special Year, Nielsen Consumer LLC, 2023

[5] A Leading Canadian Value Retailer, Investor Presentation, www.dollarama.com, March 2023

[6] Are Dollar Stores Killing our Food Economy, www.linkedin.com, December 2019

[7] A Last NIQ+FHCP Look at a Very Special Year, Nielsen Consumer LLC, 2023

[8] FMCG Canadian Quarterly Report, Q4 2023, Nielsen IQ, February 2024