Inflationary Food Wars – The Bewildered Consumer

Food is one of the necessities of life. Clothing and shelter were the others. Yet, as we finish the first quarter of 2022, many families are having trouble putting food on the table. Nielsen IQ reports 68% of Canadians are already feeling the pinch of higher prices. The global average is 56%.[i] This should come as no surprise. January 2022, the cost of food increased 5.7% over the same month in the previous year. The rate of inflation for February increased to 6.7%.[ii] By comparison, the cost of food in the United States increased by 7.9% year-on-year in February of 2022. This represented their highest food inflationary rate since July of 1981. [iii] Factors including the indirect result of the COVID-19 pandemic, labour shortages, the Federal Governments’ carbon tax, their levels of excess spending, and adverse weather related to climate change impacting food development are contributing to the strain on affordability pressures. The war in Ukraine is not welcome. Dr. S. Charlebois, Director of the Agri-Foods Analytics Lab at Dalhousie University is predicting the cost of bakery products will increase 7% in April 2022.[iv]

Unfortunately, these factors of the pandemic may continue well into 2022. Just in the past year, we have experienced, 1: 16.8% increase in beef, 2: 10.4% increase in chicken, and 3: 5.8% increase in milk.[v] The Food Bank of Canada noted an increase in demand on food banks. A recent study from the Angus Reid Institute noted, “the most economically vulnerable are the most impacted, with 90% of people in this category saying they are struggling to put food on the table”.[vi]

Unfortunately, these factors of the pandemic may continue well into 2022. Just in the past year, we have experienced, 1: 16.8% increase in beef, 2: 10.4% increase in chicken, and 3: 5.8% increase in milk.[v] The Food Bank of Canada noted an increase in demand on food banks. A recent study from the Angus Reid Institute noted, “the most economically vulnerable are the most impacted, with 90% of people in this category saying they are struggling to put food on the table”.[vi]

Canada 2021 Annual Review

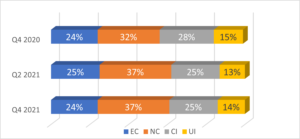

As part of their “Canada 2021 Annual Review”, Nielsen IQ noted most Canadians are now cost-constrained vs. 2020. They identified 4 consumer segments:

- Existing Constrained (EC): Watching their spending closely.

- Newly Constrained (NC): Worsening financial situation, consciously watching their spending.

- Cautious Insulated (CI): No limited income, but watching their spending.

- Unrestricted Insulated (UI): Same income level, do not watch their spending.

% Change in Consumer Segments Spending Habits

In the last quarter of 2021, 86% of Canadians were closely watching their spending levels. The biggest increase was with newly constrained Canadians. Between Q4 2020 and Q2 2021, the percentage of Canadians who had experienced worsening financial situations increased 15.6%. Not surprisingly, over the past year, discount retailers increased their market share +.6 to 44.2%, and in the process increased their market share in most food sectors including, 1. grocery (+1.2%), 2. meat & seafood (+0.8%), and 3. produce (+0.9%). [vii]

The majority of consumers are seeking ways to save money. Across the board, the tools Canadians are using are increasing,” said Hawley, CEO at Caddle. “So, they’re using their Swiss Army knife of ways they can save.” [viii]

Ways consumers are trying to save money:

- Reduce meat consumption: 51%

- Use phone apps to check prices: 68.4%

- Using flyers: 39.3%

- Purchase private label products: 30.2%.[ix]

Retail strategist Lisa Hutcheson doesn’t see prices going back to pre-pandemic levels any time soon. “These are unprecedented times, and it isn’t something we can measure against”. [x]

Though small in nature, the Canadian Federal Government could postpone its annual carbon tax increase for the next year or two. As noted by the Bank of Canada, the carbon tax does add to inflation.

Reference:

[i] Nielsen IQ Canada 2021 Annual Review, Nielsen IQ, March 2022

[ii] Canada Food Inflation, www.tradingeconomics.com

[iii] United States Food Inflation, www.tradingeconomics.com

[iv] Bread Prices Expected to Jump in April Due to Russian Invasion, www.ottawa.citynews.ca, March 2022

[v] Trudeau Must Act to Ease Worsening Inflation, www.torontosun.com, March 2022

[vi] Canada’s Inflation Rate Increase Puts More Pressure on Food Banks, www.vancouver.citynews.ca, October 2021

[vii] Nielsen IQ Canada 2021 Annual Review, Nielsen IQ, March 2022

[viii] Feeling Squeezed, www.canadiangrocer.com, March 2022

[ix] Feeling Squeezed, www.canadiangrocer.com, March 2022

[x] Dairy and Fresh Produce Prices Expected to Soar as Canada’s Inflation Hit’s 30-Year High, www.thestar.com, January 2022