Shifting Demographics – Influence on the Canadian Food Sector!

When I grew up it was customary for our family to gather for family meals. Our Mom was a stay at home mom. She voluntarily gave up her career to take care of my brother and myself. A Pharmacist by trade, as we grew older, she started to volunteer 2 days a week in the Pharmacy department of our local hospital. She did that for 25 years. Family meals as I know them are a thing of the past. A recent survey revealed only 12% of Canadian families eat dinner together 3-4 days a week, with 5% never eating dinner together at all.[i] This is in part attributed to a shift in demographics, women embracing their careers, and consumer time constraints.

Welcome to “Shifting Demographics – Influence on the Canadian Food Sector”!

Canada has undergone a dramatic change in demographics, in-part due to

- Aging population.

- Canada becoming the most multicultural country in the world.

In 1956, the median age in Canada was 27.2 years. It climbed to 39.5 years in 2006 and is projected to reach 46.9 by 2056.[ii] An aging population is a demographic headwind for food and beverage consumption. Consumer’s metabolisms change as they grow older, causing them to eat less. Millennials are poised to become the largest generation in Canada and represent a growing opportunity for the CPG sector as they accounted for 12% of all fast-moving consumer goods spending in 2018.[iii]

A multiculturalism policy was officially adopted by the Government of Canada in the mid ‘70s. Today, multiculturalism has become Canada’s identity. According to the 2016 census, 21.9% of the population was foreign-born.[iv] By 2036, over a 1/3rd of the working-age population, potentially as high as 40%, will be visible minorities.[v] As this group grows into an increasingly dominant consumer group, manufacturers need to focus their strategies and products accordingly to ensure they connect with the right consumers at the right time. For instance, products with natural ingredients (22%) followed by products without artificial ingredients (19%) influence their decision. [vi]

The emergence of the younger consumer and Canada has become a multicultural society has indeed influenced the Canadian food sector. Here are just 5 ways:

-

Clean Label

Clean label is a consumer-driven movement, demanding a return to real food and transparency through authenticity. It was sparked by the transformational values of the younger generation. They seek to understand the products’ ingredients (must be easy to recognize, understand and pronounce), where and how they were manufactured.

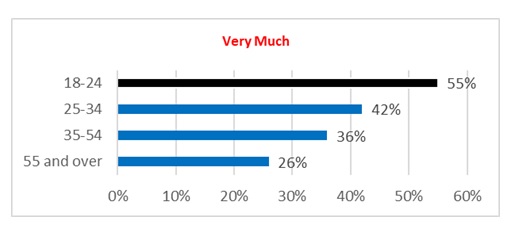

As outlined in Chart 1, the majority of consumers aged between 18-24 say clean eating improves their overall quality of life “very much”.

Chart 1

Does Clean Eating Improve the Quality of Your Life?[vii]

-

The Emergence of the Plant-Based Food Sector

Younger generations seeking a healthier life style have opted to cut milk, cheese, meat, and eggs from their diet. Today, nearly 10% of the Canadian population identify themselves as vegans or vegetarians.[viii] Many have transformed into a plant-based diet. In fact, 43% of Canadians are looking to add more plant-based foods to their diet.[ix]

Category sales in this sector topped $1.7B in 2017 representing a 7% increase.[x]

-

Cruelty Against Animals

Millennials have been at the forefront of bringing awareness of cruelty against animals in the food sector. They demand ethical foods and animals be treated with dignity. For their part, the grocery trade is listening. In response, The Retail Council of Canada’s grocery members have voluntarily committed to the objective of purchasing cage-free eggs by the end of 2025.

-

The Emergence of Ethnic Retailers

Despite the power of the ethnic shopper, most visible minority shoppers in Canada believe big box stores do not stock a sufficient selection of ethnic foods. This has given rise to the ethnic retailer. While traditional grocers are experiencing sales growth of 2% or less, ethnic retailers are thriving. Though difficult to judge, food sales through these stores are estimated at between $3B to $4.5B annually. Whatever the actual number is, it represents a substantial sales loss for conventional food stores.

-

The Emergence of the Halal Food Market

One of the fastest growing sectors in the food industry is the halal food market. Though a key market for the Muslim consumer, most consumers regardless of ethnic background, view halal-certified product to healthier than their non-certified counterpart. The Canadian Halal sector is $1B+ in sales and an underserviced population, it is projected to nearly triple in the next 20 years, growing 13% annually.[xi]

These movements represent the tip of the iceberg on how a change in demographics across this nation has influenced the Canadian food sector. Brands must keep abreast of emerging demographic trends to understand how they will impact their business today and beyond. Though the Millennial consumer is the focal point of food manufacturers, do not ignore the impact of Generation Z or that of the Ethnic Shopper.

If your brand is in need of guidance and support – Food Distribution Guy provides industry expertise and creative strategies for emerging and established food businesses that assist them in breaking through the competitive landscape and Getting and Staying listed in the grocery and health store sector.

[i] What the Future, Powered by IPSOS, Fall 2018

[ii] Demographic Change, www.150.statcan.gc.ca

[iii] Understanding and Harnessing Millennial Purchasing Power, www.nielsen.com, 2018

[iv] 2016 Census, www.12.statcan.gc.ca

[v] What Canada’s Population Will Look Like in 2036, www.globalnews.ca, January 2017.

[vi] Understanding the Powers of Ethnic Consumers in Canada, www.nielsen.com, 2018

[vii] A New Age: How Shifting Demographics are Shaping the Food Industry, Food Business News,

April 2019

[viii] More than 3 Million Canadians Vegetarian or Vegan, www.CTVnews.ca, July 2018

[ix] FCPC Launches Plant-Based Food Groups, www.canadiangrocer.com, September 2018

[x] FCPC Launches Plant-Based Food Groups, www.canadiangrocer.com, September 2018

[xi] The Canadian Halal Market, https:// Sial Canada, Nourish Food Marketing, 2018