GROCERY WARS – “THE RISE OF THE DISCOUNT RETAILER”!

As I grew up it was it was not uncommon for my Mom to go grocery shopping at our local Dominion, A&P or IGA. Oh, how times have changed. First, these 3 iconic grocery banners have been bought out by Metro or Sobeys (note: IGA franchisees exist in Quebec) and second most consumers are now grocery shopping at their local discount grocery retailer. Most consumers are familiar with the Big 6 that includes, No Frills, Food Basics, FreshCo, Walmart, Costco and Dollarama. Yet, there are 2 European discount retailers on their way to North America who are projected to fundamentally change the grocery landscape as we know it. We invite you to join us as we discuss and provide further insights into the rise of the discount retailer.

The Change in the Grocery Landscape

The economic downturn in 2008 was a global occurrence that was felt by all consumers. Many in the private sector  lost their jobs, had their salary frozen or in certain cases cut back. As such, consumers were forced to scrimp and save, with food being at the top of their list. During this period, consumers went into frugality. Though the economic news is much better, as noted by Mr. Carman Allison, Nielsen, “I think a lot of consumers during the recession found ways to cope, and consumers have stuck with those habits”. The consumer quest to save is defining retailer trends with:

lost their jobs, had their salary frozen or in certain cases cut back. As such, consumers were forced to scrimp and save, with food being at the top of their list. During this period, consumers went into frugality. Though the economic news is much better, as noted by Mr. Carman Allison, Nielsen, “I think a lot of consumers during the recession found ways to cope, and consumers have stuck with those habits”. The consumer quest to save is defining retailer trends with:

- 73.0% of consumers trying to spend less on groceries.

- 42.0% of consumers shopping more at discount retailers.

Today, nationally, 42% of all food purchases are made through discount retailers. In Ontario that number is a staggering 50%.

Retail Price is King

“The Canadian economy is rough and tumble, and it’s not going to get better for a while, so consumers will be even more frugal in 2017” – Bruce Winder – Retail Expert in December 2016 interview with CTVNews,ca. A Nielsen study reveals grocery shoppers continuing to push to find the lowest price is like a migraine that won’t go away. As part of their study it shows:

- 63.0% of shoppers decide where to shop based on the lowest price.

- 41.2% of dollars spent with a promotion or price cut. (+0.5%).

Prior to the recession, 27% of all grocery items were sold with promotion or price cut.

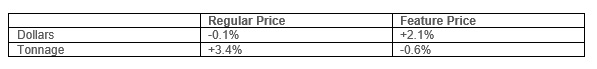

As consumers look to save money, retailers are positioning themselves as the lowest price option. Consequently, retailers are looking to adopt an EDLP (Everyday Low Price) strategy in an effort to set themselves apart from their competitors. In fact, lower regular prices are shifting the growth mix within CPG as outlined in Table 1.

Table 1

Lower Regular Prices Shifting Growth Mix in CPG

Consumers continue to seek ways to save a dollar. They include, stocking up on items when on sale (referred to as pantry loading) to studying flyers, promotions and discounts before their shopping trip. Table 2 outlines how each consumer segment goes about to save a dollar.

Table 2

How Consumers Save a Dollar When Grocery Shopping

The No Frills chain of grocery stores recently launched a major marketing campaign as part of their marketing strategy (No Frills for You) heralding the notion that shoppers don’t require “frills” such as fancy displays, product sampling or in-store entertainment. They only want low prices.

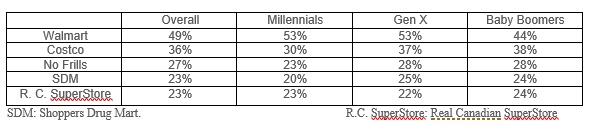

Canadians Preferred Choice for Grocery Retailer

This past year, Brand Spark International (consumer insights research firm) undertook a study to ascertain, Where Do Canadians Shop for Food and Beverage Products? Across all consumer segments 4 of the top 5 preferred banners as outlined in Table 3 were discount retailers.

Table 3

Where Do Consumers Shop for Food and Beverage Products

No Frills are forecasted to grow at more than a 5% compounded annual growth rate through to 2019.

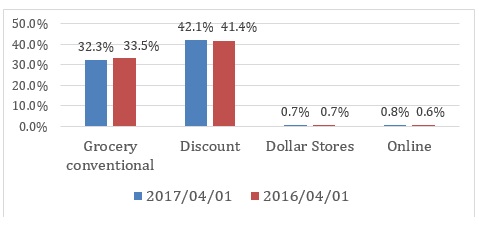

Discount Banners Stealing Market Share

With the consumer shift from conventional grocery to discount, the discount banners continue to increase their market share at the expense of their counterparts as outlined in Charts 1. Table 4 breaks down discount market share by banner.

Chart 1

Grocery Channel Market Share

Period Ending April 1/ 2017

Table 4

Discount Market Share by Banner

Period Ending April 1/ 2017

In the past 5 years dollar stores have made large gains in penetration, sales and shopping trips. They now represent $1.7B in CPG annual sales. They are also shopped by three-quarters of Canadian households. Of interest, dollar stores are gaining momentum among higher income families with 24.4% of their sales coming from households with incomes of $70,000 to $100,000.

New Competition on The Horizon

Mass disruption from discount retailers in Europe could be on their way to Canada. Aldi and Lidl are two German discount supermarket chains with 20,000 locations. Between 2003 and 2013, Lidl and Aldi grew from 8,000 locations to their present number. In Germany, their combined market share of the grocery sector is 50%. In the UK, their same-store sales are growing at a staggering rate of 30%.

Senior grocery executives in the US have begun paying attention to the European discount threat as Aldi already has 1,500 locations and accounts for about 4% of the grocery market share. Lidl has plans to open as many as 600 stores in US. The first 20 will open this summer and they plan to add another 80 stores along the East Coast by mid-2018. They are promising prices that are in some cases half those at existing supermarkets.

Fred Thomas Dupuis, partner in retail at Oliver Wyman Canada predicts “They will come to Canada in due course”. Lidl the largest grocer in Europe, has opened stores in 28 different markets and they have proven they can operate well in very diverse markets. Catherine Saul, Toronto based retail strategy consultant feels “We are not a big enough market for Aldi and Lidl to come to Canada right away”. “Probably the more immediate threat to Canadian grocers is Amazon”. This past year Amazon opened a small physical store that could be the future of grocery shopping (Amazon Go), in which one walks in, collects their purchases from the shelf and walk out – all without ever needing to line up to pay or check out.

Impact for Small Business

The rise of the discount banner is one small business must take into consideration recognizing:

- They must have a true understanding of their ideal consumer and understand what banners they shop at.

- They must come prepared to support their brand internally with promotions and price discounts.

- Does their brand identity support distribution with discount retailers? If no, they must be prepared to adjust their sales forecast and product inventory.

- They must have an e-commerce strategy. Though it only accounts for 0.8% market share in Canada, Walmart and Loblaws are emphasizing this channel as a way to combat Amazon.

For assistance in Getting and Staying Listed in Canada’s Grocery Sector, connect with us through our website: www.fooddistributionguy.com, or give us a call toll free: 1-844-206-FOOD (3662).